2020 Vehicle Miles Down, Fatality Accident Frequency Up

With Miles Driven Remarkably Down in 2020 Vehicle Fatality Deaths Have Increased

Total miles traveled by motor vehicles in 2020 were down 15% compared to 2019. However, a new report found a surprising and alarming statistic: Traffic deaths rose last year by 8% over 2019.

The National Safety Council (NSC) says deaths from motor vehicles rose 8% last year, with as many as 42,060 people dying in vehicle crashes.

When comparing traffic deaths to the number of miles driven, the rate of fatalities rose 24% — the highest spike in nearly a century, NSC says.

"It is tragic that in the U.S., we took cars off the roads and didn't reap any safety benefits," Lorraine Martin, NSC's president and CEO, said in a statement.

The non-profit organization estimates fatalities from motor vehicles every year, tallying deaths on public roads as well as parking lots and driveways.

The group advocates for lower speed limits, stricter seat belt laws and expanded use of driver-assistance features like automatic emergency braking, among other changes.

The National Highway Traffic Safety Administration (NHTSA), a government agency, has not yet released its analysis of deaths in 2020, but its preliminary results for the first 9 months of the year show similar trends, with total deaths and death rates both up noticeably.

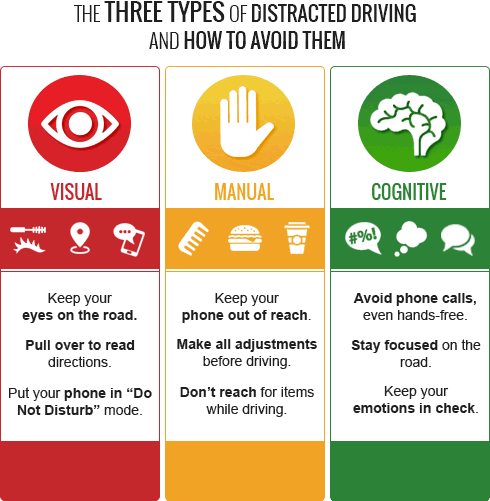

April is Distracted Driving Awareness Month

Did you know your brain can miss seeing up to 50% of your driving environment when you talk on a cell phone? And that according to research, drivers talking on cell phones had slower reaction times than drivers with a .08 blood alcohol content. April is Distracted Driving Awareness Month and is the perfect time for motor carriers to reinforce to their drivers the dangers of distracted driving and the rules and regulations being enforced by the FMCSA.

According to these regulations, Commercial Motor Vehicle (CMV) drivers are prohibited from texting or using hand-held mobile phones while operating their vehicles. Violations can result in fines and/or disqualifications and will impact a motor carrier’s and/or driver’s Safety Management System (SMS) results. Texting means manually entering alphanumeric text into, or reading text from, an electronic device. The rules also restrict a CMV driver from reaching for or holding a mobile phone to conduct a voice communication, as well as dialing by pressing more than a single button. CMV drivers who use a mobile phone while driving can only operate a hands-free phone located in proximity. In short, the rule prohibits unsafely reaching for a device, holding a mobile phone, or pressing multiple buttons.

The rules impose sanctions for driver offenses, including civil penalties up to $2,750 and disqualification for multiple offenses. Motor carriers are also prohibited from requiring or allowing their drivers to text or use a hand-held mobile phone while driving and may be subject to civil penalties up to $11,000. Violations will impact SMS results.

This month reinforce to your drivers the dangers of distracted driving. It is very easy to comply with the rules:

- No REACHING

- No HOLDING

- No DIALING

- No TEXTING

- No READING

Banning Distracted Driving: An Employer's Guide to Protect Employees and Liability

- Implement a clear policy indicating that the employer does not require employees to answer calls while they are on the road. This includes the employer placing calls to employees while they are driving.

- Encourage your employees to plan their trips to include stops so they can safely return calls and emails.

- Establish company policy that makes it unnecessary for employees to text while driving to fulfill their job duties.

- Eliminate any incentives that may encourage employees to text/talk while operating a vehicle.

Communicate your state's regulations and associated fines to employees.

Encourage employees to sign an anti-distracted driving pledge.

Designate company vehicles as "distraction-free zones."

Obtain a free cell phone policy kit from National Safety Council.

For additional information on distracted driving visit the following websites:

http://safety.nsc.org/ddam

https://www.enddd.org/

Document the Use of COVID-19 Med Card and Licensing Waivers

The COVID-19 pandemic led to several enforcement notices that extended expired medical cards and driver's licenses.

The limited availability of vital services needed by motor carriers and their drivers led to the waivers released by the Federal Motor Carrier Safety Administration (FMCSA).

If you took advantage of the medical certification and/or licensing exceptions, your recordkeeping must show the driver met the terms of FMCSA's notice and was fully qualified before its end date. A copy of each enforcement notice should be retained to show auditors, since copies may be difficult to obtain in the future.

June 1st is the deadline when all waivers will expire, and if all drivers wait, it may create a bottleneck at the State Drivers Licensing Agency (SDLA). To avoid a downgraded CDL and CLP, drivers should plan to have their updated medical cards to the SDLA by May 18, 2021, so their driving record is updated by May 28, 2021. The state has 10 days to process all medical certifications. But the waiver deadline lands on a federal holiday.

It is recommended that motor carriers obtain a new MVR prior to May 28, 2021, confirming any expired or downgraded license was brought up to date. If the driver's record is not current, an MVR request on or after June 1st is too late. You have an unqualified driver on the road.

History books will no doubt document the global pandemic. But your recordkeeping must document your motor carrier's story for future reference. In the event of an audit, you will need to explain when you used a specific waiver and prove your driver qualified. You will also need to take all the necessary steps to get your files back in compliance.

Labor Department Proposes Withdrawal of Independent Contractor Rule

The Wage and Hour Division of the U.S. Department of Labor is proposing to withdraw a Trump Administration final rule on Independent Contractor Status under the Fair Labor Standards Act, which was published on January 7, 2021 and the effective date of which is currently May 7, 2021. 86 Fed. Reg. 14027 (March 12, 2021).

The FLSA requires employers to pay non-exempt employees at least the minimum wage and overtime for all hours worked over 40 hours per week. Workers who are independent contractors are exempt from these requirements. (Drivers of commercial motor vehicles who are subject to the Department of Transportation’s hours of service rules are separately exempt from the overtime requirements, but not the minimum wage requirements, of the FLSA.)

The FLSA does not define who is an independent contractor, however. Over the years courts and the DOL have developed a multifactor test to determine whether, as a matter of economic reality, the worker is dependent on a particular individual, business, or organization for work (and is thus an employee) or is in business for him- or herself (and is thus an independent contractor).

The new rule would use a five-part test, with the first two parts considered the most important in determining the worker’s status: the nature and degree of the worker’s control over the work; and the worker’s opportunity for profit or loss based on initiative, investment, or both.

The other three parts of the test are: the amount of skill required for the work, the degree of permanence of the working relationship between the individual and the potential employer, and whether the work is part of an integrated unit of production. Also, the actual practice between the parties is more important that the terms of any contract between them.

In proposing to withdraw the final rule, the Wage and Hour Division would revert to an “economic realities” test first enunciated by the U.S. Supreme Court in 1947 in United States v. Silk, 331 U.S. 704, which says that “employees are those who as a matter of economic realities are dependent upon the business to which they render service.”

The factors to be considered under this test include:

(1) The degree of the employer’s right to control the manner in which the work is to be performed;

(2) the worker’s opportunity for profit or loss depending upon his or her managerial skill;

(3) the worker’s investment in equipment or materials required for his or her task, or employment of helpers;

(4) whether the service rendered requires a special skill;

(5) the degree of permanence of the working relationship; and (6) whether the service rendered is an integral part of the employer’s business.